Key highlights:

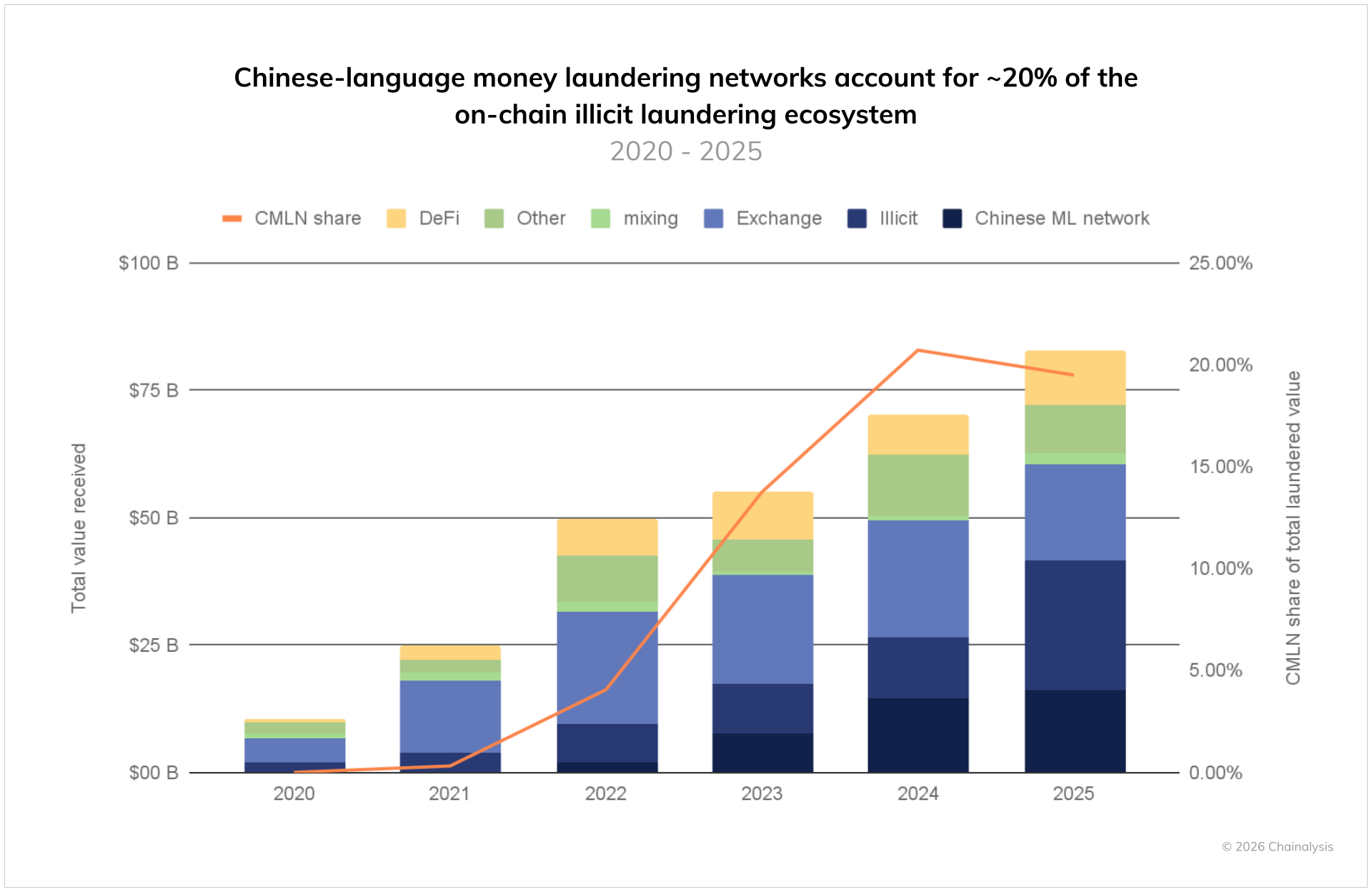

- In 2025, $82 billion in illicit cryptocurrency funds were laundered, a dramatic rise from $10 billion in 2020.

- Chinese networks now handle roughly 20% of traceable illicit cryptocurrency flows, primarily via OTC and gaming platforms.

- Centralized exchanges are losing ground because stricter regulations and security measures reduce their appeal for laundering.

Cryptocurrency launderers are increasingly abandoning centralized exchanges in favor of Chinese-based platforms, according to analytics firm Chainalysis. In 2025, over $82 billion in illicit funds were laundered through the blockchain ecosystem, highlighting the rapid growth and adaptation of laundering operations.

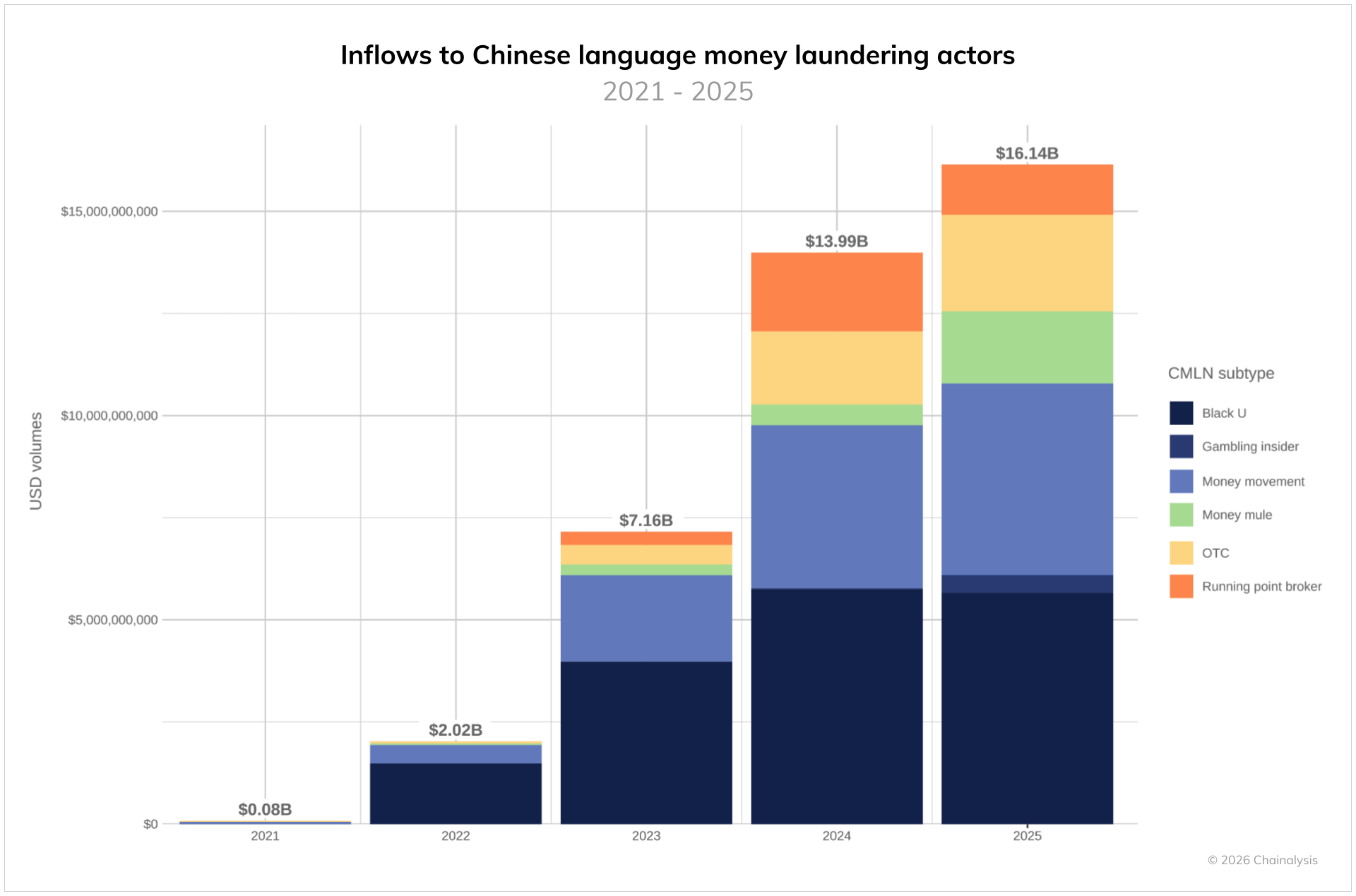

In the next preview chapter of our 2026 Crypto Crime Report, we examine how Chinese-language money laundering networks processed $16.1 billion in illicit crypto funds in 2025 (about $44 million per day across 1,799+ active wallets).

Read the full analysis here:… pic.twitter.com/0Jla3ce5X1

— Chainalysis (@chainalysis) January 27, 2026

Chinese networks now handle approximately 20% of all traceable illicit cryptocurrency flows. These networks emerged during the COVID-19 pandemic in 2020 and have since grown to dominate known cryptocurrency laundering activity.

Source: Chainalysis

Illegal service networks operating through Chinese channels offer a wide range of laundering services. They rely heavily on over-the-counter (OTC) trading platforms and online gaming platforms to mix and exchange cryptocurrencies efficiently.

Over the past five years, the inflow of funds to these networks has grown over 7,000 times faster than to centralized exchanges, processing roughly $16 billion (about $44 million per day).

Centralized exchanges are losing ground

The use of centralized cryptocurrency exchanges for laundering illicit funds is declining. Exchanges have strengthened security systems and customer verification procedures as global regulators tighten rules for cryptocurrency platforms.

Chainalysis notes that, compared to other laundering channels, the inflows to identified Chinese networks have grown far faster than those to centralized exchanges since 2020. This shift is largely because centralized exchanges can freeze funds, limiting their attractiveness to illicit actors.

Source: Chainalysis

Chinese Telegram channels and other digital services now make up a disproportionate share of global blockchain money laundering, though they are not the only intermediaries.

Blockchain money laundering continues to grow

The blockchain money laundering ecosystem continues to expand rapidly. Increased cryptocurrency liquidity and accessibility, combined with new techniques, have made laundering easier and more sophisticated.

Law enforcement agencies are under pressure to develop specialized skills to track illicit operators and the platforms they use. Tom Keatinge, director of the Centre for Finance and Security at the Royal United Services Institute, told Chainalysis that most countries have a gap between criminals’ capabilities and law enforcement expertise in cryptocurrencies.

While blockchain tracking firms provide assistance, Keatinge emphasized that a systemic, global effort is needed to enhance law enforcement capabilities and improve information-sharing mechanisms worldwide.

Analytical perspective

Historically, money laundering has always followed technological innovation. From offshore banking in the 1980s to wire transfers in the 1990s, criminals adapt quickly to new systems.

Today, privacy protocols and decentralized exchanges present new monitoring challenges. Machine learning could further enable hybrid laundering schemes, raising the question of whether detection technologies can evolve faster than criminal networks.

Source:: $82 Billion Laundered in Crypto in 2025: Chinese Networks Take Share from Crypto Exchanges