When you’re looking for the best BNB Smart Chain (BSC) DEX platforms, you have some great options at your disposal. PancakeSwap is the first one that pops to mind, with its low fees and high liquidity, while SushiSwap offers multi-chain trading and user governance.

Uniswap, a leader in decentralized trading, provides incredible token support. Other platforms like 1inch and Aster each bring unique features (or at least a unique twist to certain features) to the table. Whether you prioritize security, yield farming, NFT trading, or advanced market models, there’s a BSC DEX platform that suits your needs.

But which one will you choose?

Key highlights:

- PancakeSwap is a top BSC DEX with features like AMM, low transaction costs, and high liquidity levels exceeding $1.7 billion TVL.

- Uniswap operates on BSC among other chains, providing AMM model swaps, high trading volume, and governance through the UNI token.

- 1inch aggregates liquidity from various DEXs to minimize slippage and reduce swap costs, operating across multiple blockchains.

- Aster – DEX with perpetual contracts and high leverage

- Thena – A trading hub for the BNB Chain ecosystem

- ApeSwap features an AMM model, high-security standards, and rewards in BANANA tokens for liquidity provision, offering additional features like an NFT marketplace.

What are BNB Smart Chain DEXes?

Before diving into our list, it’s important to understand what a BNB Smart Chain DEX even is. DEX stands for “decentralized exchange,” which is a peer-to-peer marketplace where users can trade cryptocurrencies without needing an intermediary. This makes the process of buying and selling crypto faster (as transactions don’t need to go through a third-party wallet), reduces centralization risks, and helps avoid potential hacks and fraud.

A BNB Smart Chain DEX is simply a decentralized exchange built on the BNB Smart Chain network. It leverages the network’s strengths to provide users with a seamless, efficient, and secure trading experience, enabling you to explore the BNB ecosystem, from DeFi tokens to NFTs, all while benefiting from the network’s low fees and fast transactions.

To see how they differ from the more traditional centralized exchanges, see our article comparing the CEX vs DEX differences.

Best BNB Smart Chain DEX platforms

Now, with the basics out of the way, we can dive into our selection of the best BNB Smart Chain DEX platforms in 2024.

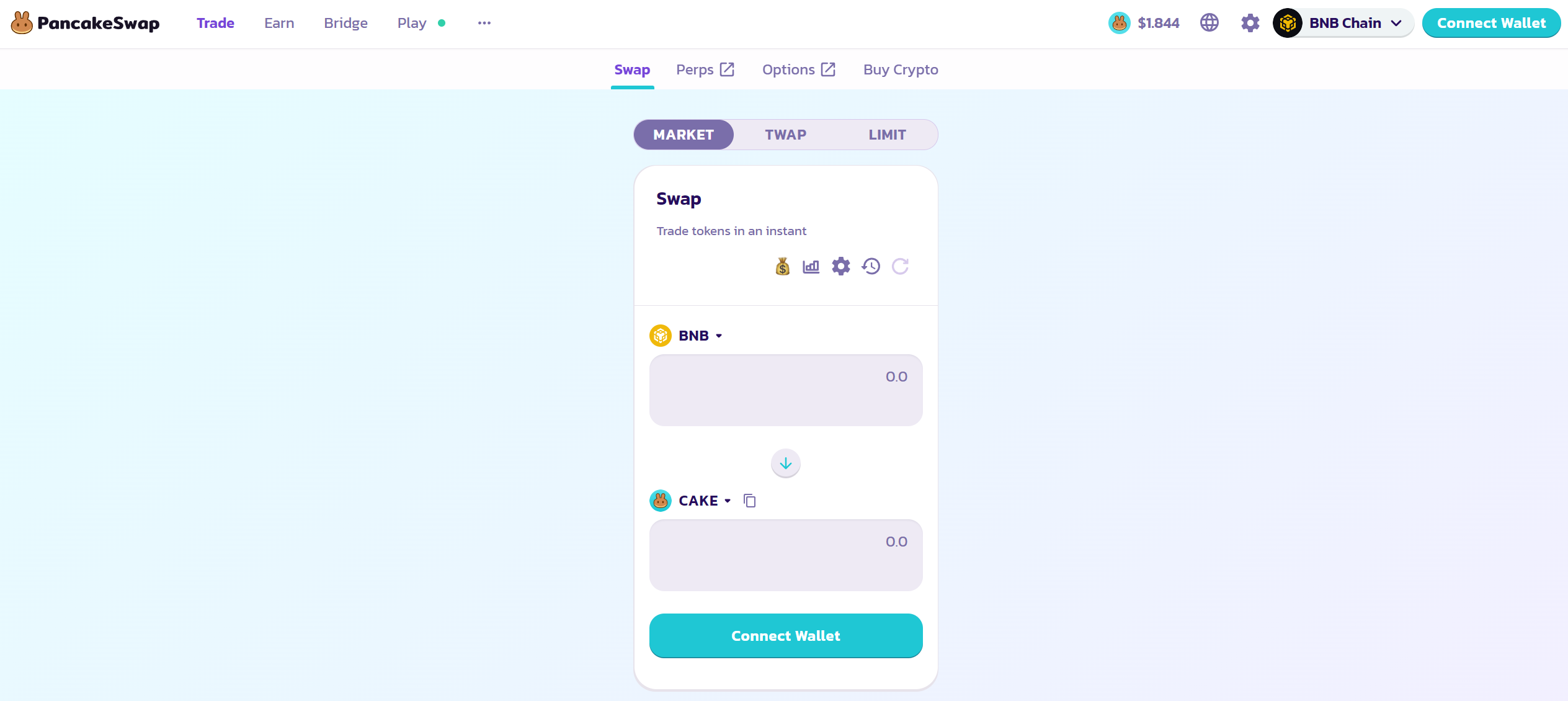

1. PancakeSwap – The best BNB DEX overall

When someone mentions a BSC DEX, the first thing that pops into anyone’s head should be PancakeSwap. This leading Automated Market Maker (AMM) offers a decentralized trading experience with low fees and fast transaction speeds, along with yield farming and liquidity provision opportunities that earn users rewards in the form of CAKE.

Best of all, it has the highest liquidity out of all the dedicated BSC decentralized exchanges, which cements its place as the leading BSC DEX.

Key features:

PancakeSwap’s architecture is centered around its Automated Market Maker (AMM) model, which facilitates fast and cost-effective token swaps with transaction fees as low as 0.2%.

One of the standout features is its yield farming capabilities, which allows you to stake your liquidity provider (LP) tokens to earn rewards in the form of CAKE tokens. The platform offers a gamified user experience, incorporating elements such as lottery systems, prediction markets, and collectible NFTs.

PancakeSwap also supports cross-chain compatibility through integrations, so you can interact with multiple blockchain networks while providing liquidity across various trading pairs.

This decentralized trading platform consistently maintains high liquidity levels, often surpassing $2 billion in Total Value Locked (TVL). These features collectively position PancakeSwap as a leading DEX in the BSC ecosystem, offering you a thorough and efficient trading experience.

PancakeSwap set the standard for decentralized exchanges on the Binance Smart Chain, and it still remains the leader in this domain. Simply put, it is the best BSC DEX all around.

Pros:

- Low transaction fees of 0.2%, making it cost-effective for trading.

- User-friendly interface with gamification elements like trading competitions and NFT rewards.

- Diverse liquidity options, including yield farming and staking for CAKE tokens.

- Robust liquidity pool system contributing to high Total Value Locked (TVL) exceeding $1.7 billion.

- Cross-chain compatibility through integrations with multiple blockchain networks.

Cons:

- Risks associated with impermanent loss inherent in DeFi platforms.

- Potential smart contract vulnerabilities that could affect user funds.

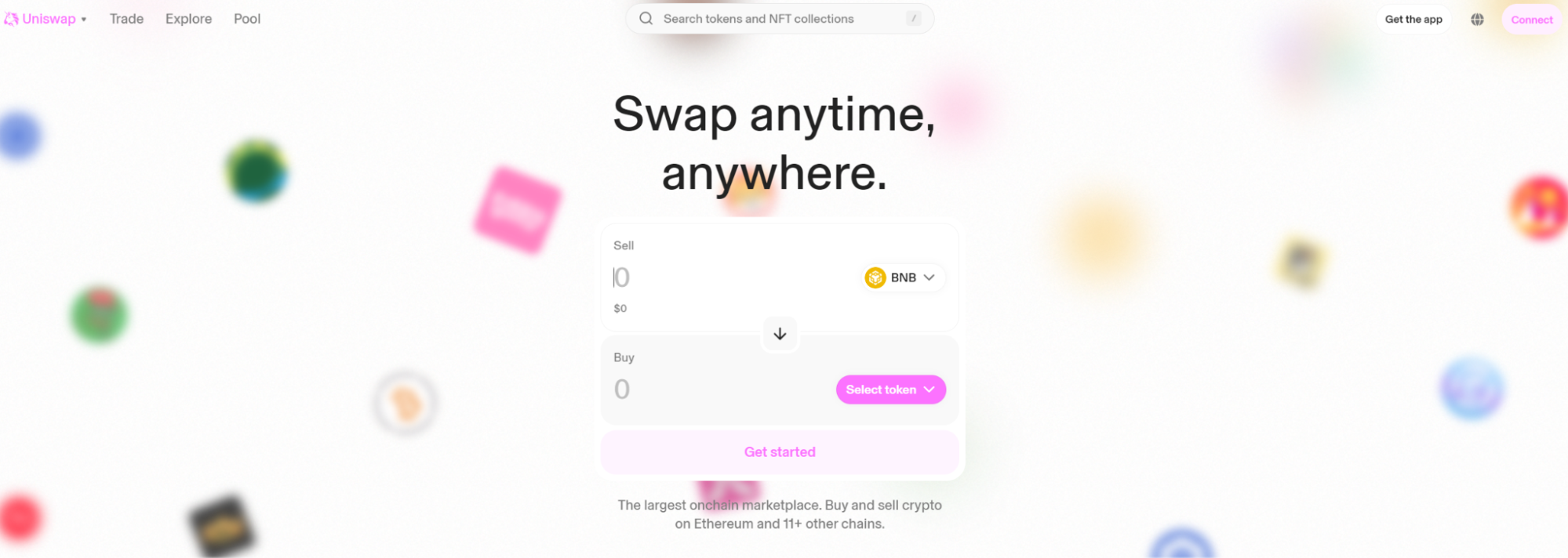

2. Uniswap – Biggest DEX in the crypto space

Uniswap is the biggest and most established DEX in the crypto space. It revolutionized trading by enabling users to swap ERC-20 tokens without intermediaries. While Uniswap was not the first DEX ever, one thing is clear – Uniswap is the one that changed decentralized trading, forever.

Although primarily built on the Ethereum blockchain, Uniswap has implications for the broader DEX landscape, and it’s expanded to allow multiple chains, including BSC. Uniswap is also one of the best DEX with limit orders, a feature that went live on their platform in early 2024.

Key features:

Uniswap’s key features are built around its automated market maker (AMM) model. You get to enjoy a vast array of tokens, and the platform’s trading volume has exceeded $1 trillion since its launch in 2018. It’s the biggest decentralized exchange available.

By participating in the ecosystem, you can provide liquidity to different pools and earn trading fees proportional to your contributions. This incentivizes active participation as you’re rewarded for providing liquidity.

Uniswap’s governance model is particularly significant, as it allows UNI token holders to propose and vote on changes to the protocol, which makes the decision-making process truly decentralized.

The platform’s user-friendly interface (at least as much as a DEX can be) and integration with various DeFi wallets streamline the trading process. It’s definitely helpful for beginners. This ease of use, combined with its extensive range of supported tokens and very high liquidity, makes Uniswap a leading DEX in the market.

This is particularly true for those looking to engage with ERC-20 tokens, but the DEX is so big that even for its non-primary chain, BSC, the liquidity is impressive.

Pros:

- Largest DEX by trading volume with high liquidity and a wide range of trading pairs.

- User-friendly interface suitable for both beginners and experienced traders.

- Efficient token swaps through its Automated Market Maker (AMM) model.

- Governance through the UNI token, granting holders voting rights on protocol proposals.

- Supports multiple chains, including BSC, expanding its accessibility.

Cons:

- Higher gas fees during periods of Ethereum network congestion, increasing trading costs.

- Primarily built on Ethereum, which may not be ideal for users specifically seeking BSC DEX platforms.

3. 1inch – DEX aggregator enabling seamless trading

1inch is interesting. It’s a DEX aggregator that optimizes trades by sourcing liquidity from various DEXes to provide the best available swap rates.

The key aspect of its functionality is the Pathfinder algorithm, which minimizes slippage and reduces costs associated with token swaps. This enables seamless trading across multiple blockchain networks.

Key features:

You can trade a wide variety of tokens seamlessly on 1inch, thanks to its support for multiple blockchains. This cross-chain capability enhances the platform’s accessibility and utility for users.

1inch offers limit orders and liquidity protocols for better capital efficiency for traders. Similar to other exchanges on our BSC DEX list, 1inch also offers liquidity mining opportunities, so users are incentivized to participate in the platform’s ecosystem, as they earn rewards for providing liquidity.

1inch’s user-friendly interface and sleek design make it appealing to beginners. It integrates advanced trading features that allow you to execute trades efficiently.

Pros:

- Aggregates liquidity from various BNB DEX exchanges to provide the best available swap rates.

- Pathfinder algorithm minimizes slippage and reduces swap costs.

- Supports multiple blockchains, enhancing accessibility and trading options.

- Offers advanced trading features like limit orders and customizable strategies.

- Provides liquidity mining opportunities for users to earn rewards.

- User-friendly interface with a sleek design appealing to beginners.

Cons:

- Dependence on underlying DEXs can affect performance based on external liquidity factors.

- Complex transactions may involve multiple platforms, potentially increasing complexity.

- Possible higher transaction fees due to interactions with multiple DEXs.

4. Aster – DEX with perpetual contracts and high leverage

Aster is a multi-chain decentralized exchange that supports BNB Chain in addition to a variety of other leading blockchains. Unlike most of the other platforms featured in this article, which focus on spot crypto swaps, Aster is designed for the trading of perpetual contracts. This allows Aster users to go long or short on a variety of crypto assets with high leverage.

However, Aster does also provide spot trading, mostly in stablecoin-denominated pairs. The spot trading experience on Aster is more similar to using a centralized exchange than using an AMM platform such as PancakeSwap and Uniswap. For spot trades, Aster offers market, limit or stop limit orders.

Key features:

Aster is an easy-to-use DEX that provides a user interface similar to centralized exchanges, which means most crypto traders will feel right at home. The platform gives users the option to submit limit orders which are hidden from the public order book, ensuring a fairer marketplace.

Besides the traditional perpetual contract trading mode, Aster also has the “1001x” ultra-high leverage trading mode, which features leverage of up to 1,001x. Needless to say, we don’t really recommend using extreme leverage, as it’s more akin to gambling on a slot machine than trading.

In addition to trading crypto assets, Aster users can also speculate on a variety of stocks using high leverage of up to 100x. At the time of writing, Aster has 12 contracts tied to stocks, including popular stocks like Apple and Tesla.

Pros:

- Supports multiple blockchains

- Perp and spot trading

- Lists stocks-based perps in addition to crypto perps

- High flexibility when it comes to leverage

- Traders have the option of using hidden limit orders

Cons:

- Selection of listed assets is small comparable to CEXes

5. Thena – A trading hub for the BNB Chain ecosystem

Thena is a decentralized crypto exchange building toward a “SuperApp” that combines trading, liquidity, lending, and AI-powered financial tools into a single, seamless onchain experience. Designed to deliver a CEX-grade interface without sacrificing decentralization, Thena aims to onboard users of all levels through features like wallet abstraction, fiat on- and off-ramps, cross-chain transfers, and self-custodial earning products.

The Thena project is positioning itself as a decentralized alternative to centralized exchanges on BNB Chain, integrating spot trading, perpetuals, and future banking-style services under one unified platform.

Key features:

Thena offers cross-chain bridging for seamless asset transfers, instant access to spot market trading, and self-custodial earning through single-asset staking of major cryptocurrencies like BTC, ETH, BNB, and USDT.

The platform also supports crypto perpetuals trading on over 300 assets with leverage of up to 50x, while upcoming features include permissionless trading competitions and exclusive launchpools that give users early access to new projects.

Pros:

- Streamlined user experience

- Users can access leverage of up to 60x

- Very broad selection listed crypto assets

- Choose between market and limit orders

- Spot and perp trading

Cons:

- Liquidity is lower than what you’ll find at competitors like Hyperliquid and Aster

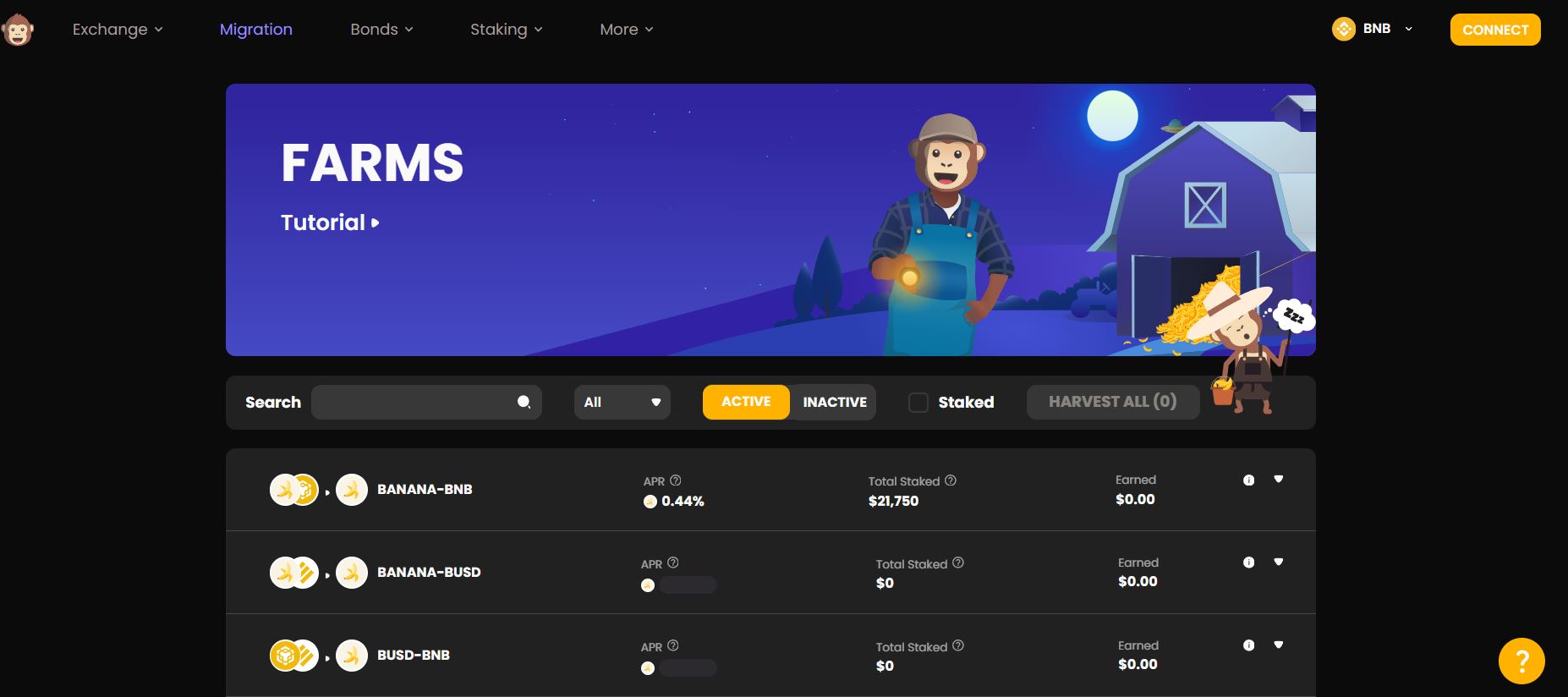

6. ApeSwap – DEX with gamified element

ApeSwap offers a vibrant community and gamified elements that enhance user engagement. It offers a range of DeFi services, including yield farming and staking.

This platform also includes additional functionalities such as a launchpad for new token projects, an NFT marketplace for trading digital collectibles, and a built-in staking mechanism for its native token, all designed to improve liquidity options and lower transaction fees.

Key features:

The ApeSwap platform aims to deliver a seamless trading experience characterized by low transaction fees and enhanced security measures, so it’s an attractive choice for users on the BNB Smart Chain.

You get a user-friendly interface that simplifies the swapping process, so beginners should have an easier time trading.

You can take advantage of innovative yield farming opportunities by staking your tokens and earning rewards in the form of ApeSwap’s native token, BANANA.

Their launchpad is a cool feature, as it allows you to participate and gain access to exclusive token launches. This way, you get in on a project from the ground up.

Also, the platform incorporates robust security measures, including rigorous audits to safeguard user funds and provide a secure trading environment.

Similar to other entries on our list, ApeSwap actively engages its user base through governance initiatives, so participants can be a part of the decision-making process.

Pros:

- AMM model facilitates seamless swapping between BEP-20 tokens without an order book.

- Low transaction fees of around 0.3%, ideal for frequent traders.

- Rewards liquidity providers with BANANA tokens, offering competitive APYs.

- Gamified elements like trading competitions and NFT rewards enhance user engagement.

- Additional features like an NFT marketplace and launchpad for new token projects.

Cons:

- May face liquidity depth challenges compared to larger DEX platforms on BSC.

- Potential limitations in trading options and asset availability.

- Growth is dependent on community engagement and regulatory compliance.

Frequently asked questions

Which decentralized exchanges support BSC?

Several decentralized exchanges support the Binance Smart Chain (BSC), including PancakeSwap, SushiSwap, Uniswap, 1inch, ApeSwap, BakerySwap, and KnightSwap. These platforms offer features like low transaction fees, high liquidity, yield farming, and NFT trading, providing users with multiple options for decentralized trading on the BSC network.

What is the best DEX for BSC chain?

PancakeSwap is often considered the best DEX for the BSC chain due to its low transaction fees of 0.2%, high liquidity exceeding $1.7 billion in TVL, and user-friendly interface with gamified elements. It offers diverse liquidity options, yield farming, and staking for CAKE tokens, so it’s a comprehensive platform for traders and investors.

Can I trade NFTs on BSC decentralized exchanges?

Yes, you can trade NFTs on certain BSC decentralized exchanges like BakerySwap and ApeSwap. BakerySwap integrates NFT functionalities directly into its platform, which lets you buy, sell, and stake NFTs. ApeSwap also features an NFT marketplace and incorporates gaming elements, so you have additional opportunities to engage with NFTs alongside traditional token trading.

What are the risks associated with using BSC DEX platforms?

While BSC DEX platforms offer benefits like low fees and high liquidity, they come with risks such as impermanent loss when providing liquidity and potential smart contract vulnerabilities, as well as the risk of scams that are always present in crypto. You should also be cautious of market volatility and the possibility of slippage, especially with less popular tokens or during periods of low liquidity.

The bottom line

When using BNB Smart Chain (BSC) for decentralized trading, you must choose a DEX that aligns with your specific needs. Platforms like PancakeSwap offer low fees and high liquidity, while SushiSwap provides multi-chain trading and user governance.

Uniswap, 1inch, ApeSwap, BakerySwap, and KnightSwap each bring unique features to the table, from extensive token support to NFT trading and yield farming. Use the distinct advantages of each DEX to help you make the right choice.

For more reviews of decentralized exchanges, here is a list comparing the best Solana DEX platforms.